Buying a house or renting an apartment: making the right choice

When it comes to planning your future, the choice between buying and renting is a crucial step. This decision has a huge impact on your finances, your long-term stability and your lifestyle.

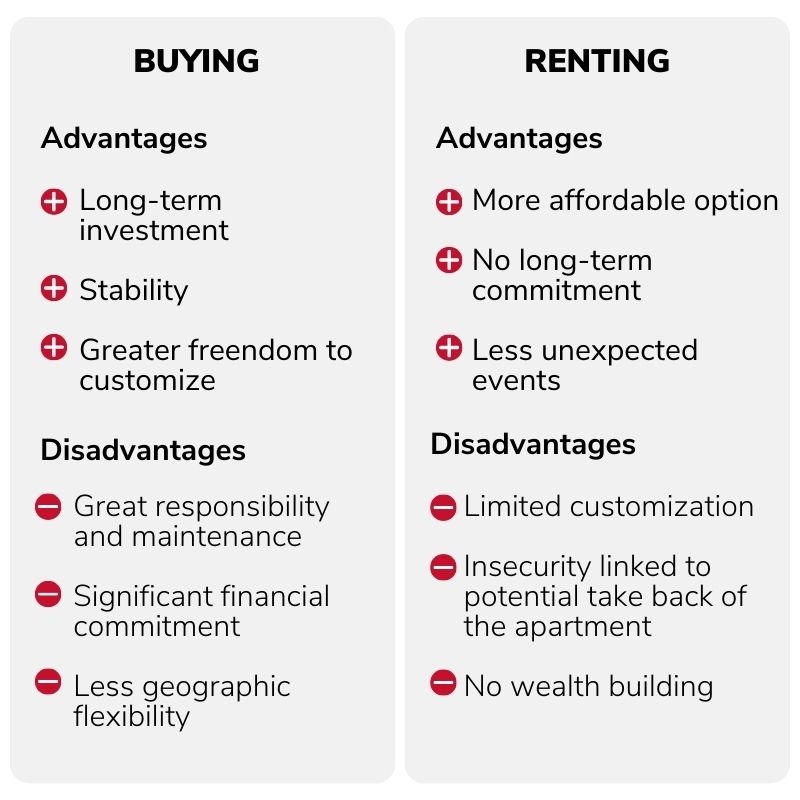

Identifying the pros and cons of buying and renting will help you make the best decision based on your personal situation.

Is it better to buy or rent a house?

It depends entirely on you and your needs.

One of the most widespread myths is that renting is not at all advantageous since it translates into a waste of money. This statement ignores the fact that each situation is different. Indeed, buying a house as much as renting an apartment has its benefits and disadvantages.

What matters, when making your decision, is to evaluate whether it is better for you to rent or buy, depending on the context.

Your choice will depend, among other things, on the following elements:

- Your current and future needs

- Your financial capacity

- The real estate market and its trends

Your current and future needs

An important first step is to carefully assess your lifestyle and define your needs.This will allow you to determine not only whether buying is a good solution, but also what type of property to consider.

Where do you see yourself in 5 years? Do you plan to have children? Are you thinking of moving in two years? Will your situation change?

Consider your current needs as well as your future needs to ensure that your decision will still suit you in 5 years.

Your financial capacity

First essential question: can you afford to buy a house?

Buying a property generates many significant costs, the main one being the down payment (5% to 20% of the purchase price).To this, we add other costs related to buying a property such as notary fees, inspection fees, land transfer tax, etc. Next, you need to consider the mortgage, maintenance, and building an emergency fund for the unexpected.

Based on your budget and an assessment of the financial implications of buying and maintaining a property, you will determine if you have the capacity (and the desire) to become a homeowner.

Second essential question: do you qualify for a mortgage?

When you make the decision to purchase, request a mortgage pre-approval to determine if you qualify for a loan and what is the maximal amount you are eligible for. This decision is based, among other things, on your assets, your income and your level of indebtness.

The current real estate market and its trends

The market is evolving quickly, and keeping track of what is happening is essential to assess your options.

For example, property prices have increased significantly over the past years. Property access has become more difficult, which led many households to reassess their projects.

On the other hand, vacant housing is becoming rarer and rent prices have also increased. Becoming a homeowner can be interesting to have more control over your situation.

Buying a property

Becoming a homeowner is the dream of many people to start a family and build happy memories.

The main advantages of buying a house

Buying a house is an option of choice to design a space to your taste and invest in your future. Indeed, becoming a homeowner comes with major advantages.

- A long-term investment: The money invested in your house allows you to build wealth. Your property has the potential to increase value over the years.

- Stability and freedom: The house belongs to you, giving you the freedom to personalize it to your taste. You can arrange the spaces and renovate your home to your liking so that it reflects your image. In addition, becoming a homeowner brings residential stability in the long term.

The disadvantages of being a homeowner

For most people, buying a house is their largest transaction, and it involves a great deal of responsibility. Becoming a homeowner also has some disadvantages.

- Greater responsibility: As a homeowner, you are responsible for maintaining and repairing the property, which can be costly and time-consuming.

- Significant financial commitment: Buying and maintaining a property entails a number of costs: down payment, mortgage, insurance, maintenance, emergency fund, etc. You could also have to face unforeseen events or an increase in interest rates.

- Less flexibility: When you own a house, moving requires greater thought and more responsibility since you have to take into account the financial aspect and the fact of having to sell your property before finding another one.

Practical advice for the purchase of a house

1. Inform yourself

Take the time to learn what buying and maintaining a property involve and to carefully assess your needs and situation. Having a good and clear understanding will help you make the right decisions to succeed in your project and secure your future.

2. Make a budget

Set a budget to have a clear and fair idea of your finances. This will allow you to assess your capacity to buy a house, but also, to cover the costs once you own it.

3. Set up an emergency fund

Unforeseen events related to a property can be costly. Set up an emergency fund to ensure that you are not in a bind in the event of urgent repairs and other unforeseen situations.

Renting an apartment

Becoming a homeowner is not an obligation. Some people decide to remain tenants for multiple reasons:

- Your situation is not stable enough to commit to the purchase of a house.

- You plan to move in the next few years and are not ready to commit.

- You need time to raise the money required to buy a house.

- You do not want to take on the responsibility in time and money that comes with buying and maintaining a property.

- You are comfortable in your current situation and do not feel the need for a change.

- Etc.

Renting can also be an advantageous temporary situation. Particularly when property prices and interest rates are high, it can be a good idea to rent an apartment for a few years in order to be well prepared for the purchase of your first house. You can also take this opportunity to raise a more interesting amount for the down payment and other associated costs.

The ideal situation is to make a budget and practice saving so that you are well positioned to assume the financial burden of a property.

The main advantages of renting an appartement

Compared to buying a house, renting an apartment has its share of advantages which may be suitable for many people, even in the long term.

- A more affordable option: The only amounts to pay for the apartment are fixed and predictable: rent, Internet, electricity and hot water. As a general rule, renting is more economical, which allows for a greater financial freedom.

- No long-term commitment: A lease is usually valid for one year and you have the option of not renewing, without penalty or obligation. This gives you greater freedom and flexibility.

- Less responsibilities: The landlord is responsible for repairs and unforeseen events. The tenant does not have to worry about maintenance (other than his own living space).

The disadvantages of renting

While owners enjoy greater control over their property and their future, tenants are more limited.

- Limited customizing: Since you live in someone else’s property, you are responsible to keep it in good condition. You do not have the flexibility to renovate the space or to adapt it entirely to your taste.

- A certain degree of insecurity: As a tenant, you are exposed to the risk of the owner taking back the apartment to house himself or a member of his immediate family. He may also evict you to carry out major renovations.

- No wealth building: The rent money that you pay does not come back to you and therefore, does not contribute to investing for the future.

Practical advice for renting an apartment

1. Learn to carefully manage your money

Since you are not building wealth with a house, you must invest in your future in a different way. This involves learning to manage your money effectively in order to build financial value.

2. Know your rights as a tenant

Knowing your rights as a tenant can save you a lot of hassle. Do your research to find out what your rights and obligations are, for greater peace of mind.

You will find a lot of information on the Tribunal administratif du logement (Régie du logement) web site.

Read our article on What to know before renting an apartment for more tips.

Buying a house or renting an apartment: in summary

The options of buying a house or renting an apartment each have their benefits and disadvantages.

Tools to assess your situation

There are many free tools to help you assess your situation and determine whether it is more advantageous to rent or buy a house.

To determine whether it is better for you to rent or buy a house, take the time to weigh the pros and cons, assess the advantages and disadvantages, and most importantly, make a decision that best fit your goals and your present and future needs.

Whether you want to rent or buy, seek the help of a real estate broker to make the process easier and to ensure the success of your project.